Introduction

GQG Partners is a well-known investment management firm that focuses on global and emerging markets. They are known for their rigorous research process and focus on long-term value creation. One of the companies that GQG Partners has recently shown interest in is Adani Power, a leading player in the Indian power sector. In this article, we will analyze the investment potential of Adani Power from the perspective of GQG Partners.

Adani Power: Company Overview

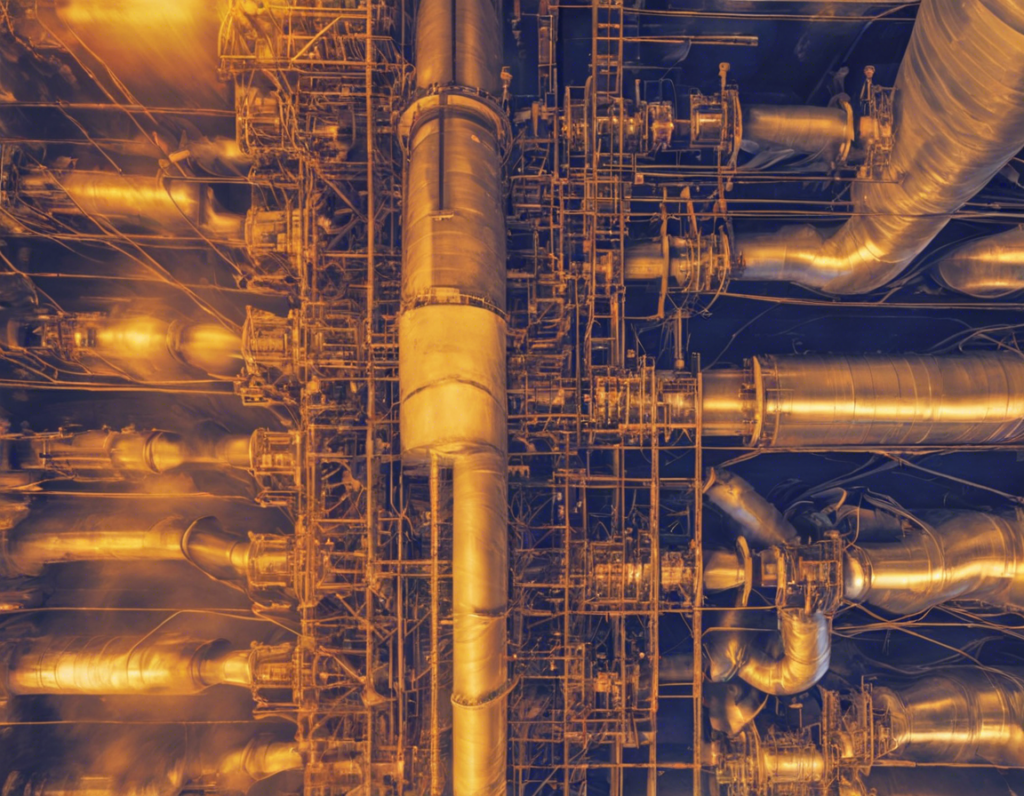

Adani Power is part of the Adani Group, one of India’s largest business conglomerates. The company is involved in the generation of thermal power and operates several power plants across India. Adani Power has a significant presence in both coal-based and renewable energy projects, positioning itself as a key player in India’s energy sector.

GQG Partners’ Investment Thesis

GQG Partners’ interest in Adani Power may stem from several factors. Firstly, India’s growing energy needs present a significant opportunity for companies like Adani Power to expand their operations and capture market share. With a focus on increasing electrification and industrialization, India’s power sector is poised for substantial growth in the coming years.

Market Position and Competitive Advantage

Adani Power’s market position and competitive advantage play a crucial role in attracting investment interest. The company’s diverse portfolio of power plants, including both thermal and renewable energy assets, provides a strategic advantage in catering to different segments of the market. Additionally, Adani Power’s strong distribution network and efficient operations further enhance its competitive position.

Regulatory Environment and Risks

Investing in the power sector, especially in emerging markets like India, comes with its share of regulatory challenges and risks. Fluctuating fuel prices, policy changes, and environmental regulations can all impact the operations and profitability of companies like Adani Power. GQG Partners’ thorough understanding of the regulatory environment and risk management practices of Adani Power would be essential in assessing the long-term viability of the investment.

Financial Performance and Growth Prospects

Analyzing the financial performance and growth prospects of Adani Power is critical in determining its investment potential. GQG Partners would likely assess key financial metrics such as revenue growth, profit margins, cash flow generation, and debt levels to gauge the company’s financial health. Additionally, understanding Adani Power’s expansion plans, capital allocation strategy, and ability to adapt to changing market dynamics would be essential in predicting its future growth trajectory.

Sustainability and ESG Considerations

As a responsible investor, GQG Partners is likely to consider sustainability and environmental, social, and governance (ESG) factors in its investment decisions. Adani Power’s commitment to clean energy initiatives, community engagement programs, and adherence to ethical business practices would be key areas of evaluation for GQG Partners. Companies with strong ESG practices are increasingly viewed favorably by investors looking for sustainable long-term value creation.

Conclusion

In conclusion, GQG Partners’ interest in Adani Power reflects the company’s potential as a key player in India’s dynamic power sector. By focusing on Adani Power’s market position, competitive advantage, regulatory environment, financial performance, growth prospects, and sustainability practices, GQG Partners can assess the investment potential of the company comprehensively. Understanding the nuances of the Indian power market and evaluating Adani Power’s strategic positioning will be crucial for GQG Partners in making informed investment decisions.

FAQs

1. What are some key factors driving GQG Partners’ interest in Adani Power?

GQG Partners’ interest in Adani Power is likely driven by India’s growing energy needs, Adani Power’s market position, competitive advantage, financial performance, growth prospects, and sustainability practices.

2. How does Adani Power differentiate itself from its competitors in the Indian power sector?

Adani Power differentiates itself through its diverse portfolio of power plants, strong distribution network, efficient operations, and commitment to both thermal and renewable energy projects.

3. What are some regulatory risks associated with investing in companies like Adani Power?

Regulatory risks for companies like Adani Power include fluctuating fuel prices, policy changes, and environmental regulations that can impact operations and profitability.

4. How does Adani Power address sustainability and ESG considerations in its business practices?

Adani Power addresses sustainability and ESG considerations through its clean energy initiatives, community engagement programs, and adherence to ethical business practices.

5. How does GQG Partners evaluate the long-term viability of investments in the power sector?

GQG Partners evaluates the long-term viability of investments in the power sector by assessing factors such as market dynamics, regulatory environment, financial performance, growth prospects, and sustainability practices of companies like Adani Power.